This story was originally published online at blackvoicenews.com.

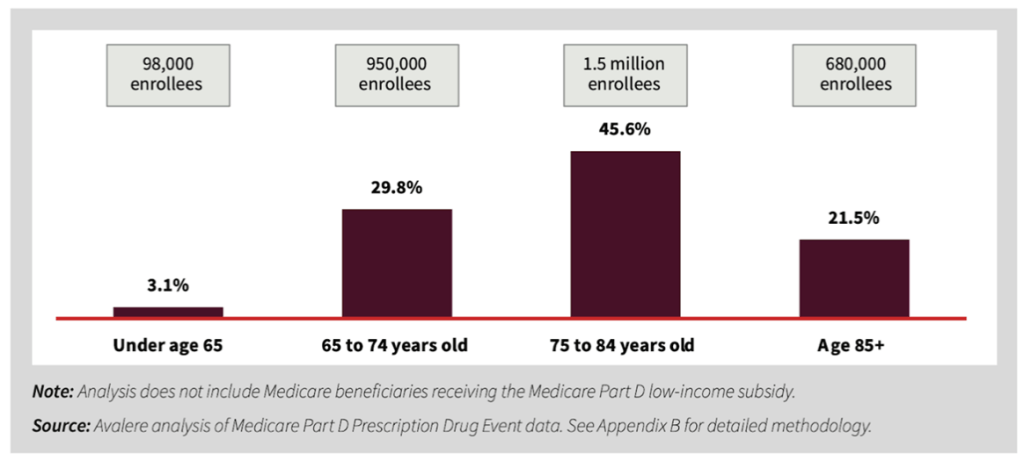

According to a new report released by AARP, an estimated 3.2 million Medicare Part D enrollees could benefit from the out-of-pocket prescription drug cap in 2025.

Under the Inflation Reduction Act (IRA) of 2022, out-of-pocket prescription drug costs for Medicare Part D enrollees will be capped at $2,000 per year starting in 2025. AARP commissioned Avalere, a healthcare consulting and advisory firm, to analyze Medicare Part D enrollees who will benefit from the new out-of-pocket limit between 2025 and 2029.

More than 50 million Medicare beneficiaries are enrolled in Medicare Part D plans, and their average out-of-pocket spending was expected to be roughly $2,600 in 2025, according to the AARP report. With the new cap, their average out-of-pocket spending is estimated to be approximately $1,100.

“Today, upwards of 95% of Americans aged 65 and older have at least one, and close to 80% are dealing with two or more, chronic conditions, things like diabetes and heart disease, as well as the debilitating neurological diseases like Parkinson’s and MS [Multiple sclerosis],” said Nancy LeaMond, AARP executive vice president and chief advocacy & engagement officer, during a media briefing.

“For those folks and their families, prescription drugs are a lifeline, but medicine is only effective if you have the money to pay for it.”

In addition to this cap taking effect in 2025, last month the Biden-Harris Administration announced new, lower prices for ten prescription drugs covered under Medicare Part D beginning in 2026. Among those drugs are Januvia, a medication used to treat type 2 diabetes and other medications for treating kidney disease and heart failure.

A research report conducted by the Office of the Assistant Secretary for Planning and Evaluation (ASPE), an advisory group to the U.S. Secretary of the Department of Health and Human Services (HHS), noted that prior to the Inflation Reduction Act, Medicare Part D enrollees who did not receive the low-income subsidy paid the most in out-of-pocket costs — an average of $3,093 per year — for their prescriptions.

The AARP analysis estimated that the number Medicare Part D enrollees in California, who are not receiving the low-income subsidy, and will benefit from the new out-of-pocket cap in 2025 is 271,477 enrollees.

More than Three-quarters of Part D Enrollees Who Will Benefit in 2025 are Between the Ages of 65 and 85

“One of the biggest challenges in the original Medicare Part D benefit was the lack of a cap on out-of-pocket spending. Even after reaching a certain threshold, enrollees were still required to pay 5% of their drug costs, with no limit for those on expensive medications,” explained Leigh Purvis, prescription drug policy principal at the AARP Public Policy Institute, during the briefing.

Purvis detailed how out-of-pocket expenses could exceed $10,000 per year for some individuals, which is a costly amount for anyone, especially for Medicare enrollees who are on a fixed income.

Using 2022 data, the ASPE noted that enrollees with chronic health conditions could be “especially at risk for high drug costs in Part D.” For Medicare enrollees over the age of 65, research found that roughly 11% with asthma or chronic obstructive pulmonary disease (COPD) reported having affordability challenges and 10% with diabetes reported affordability challenges.

“Affordability challenges are higher for Black and Latino enrollees (about 10% each) relative to white enrollees (about 6%). Among Medicare enrollees who are under the age of 65, nearly a quarter report drug affordability problems,” according to the report.

In addition to the cap lessening the out-of-pocket cost burden on enrollees, there will be other changes to the benefit in terms of who is shouldering the costs.

Currently, in all Part D plans, an enrollee enters catastrophic coverage after they reach $8,000 in out-of-pocket costs for covered prescription drugs. When this occurs, the beneficiary pays nothing and the Medicare program covers 80% of the costs and Medicare Part D is responsible for 20%.

Starting in 2025, the Medicare Part D plans will be responsible for 20% of the costs for brand-name prescription drugs and 40% for generic drugs. Part D plans will pay 60% of the costs, Medicare will be responsible for 20%, and manufacturers will pay 20%. The beneficiary will be responsible for paying nothing.

“That’s a significant shift that will relieve some of the pressure on the Medicare program, and it’s also expected to help encourage the Part D plans to do a better job of negotiating on behalf of their enrollees, because they will be, for lack of better way to put it, on the hook for more of the people who are facing those high costs,” Purvis said.

Over the next five years, as the new changes take effect, the goal of the benefit is to provide enrollees with affordable access to their prescription medications without breaking their banks. The AARP analysis estimates that in 2029, 346,068 or 8.1% of enrollees in California will benefit from the out-of-pocket cap.